Publications

Using your card or phone to pay for goods and services is great – until it’s not. For six million Australians, particularly the older population (according to the RBA), physical cash is still a necessary part of life. Without doubt, a multitude of businesses went cashless during the Covid-19 pandemic. However, with many still not returning to accept cash payments, customers are left with no choice but to walk away, going on to negatively impact a merchant’s revenue potential.

A recent survey reported that 99.7% of 15,000 participants want to retain the ability to pay with cash in Australia. Additionally, each note says, “legal tender” and “pay to the bearer”, meaning that the paying customer should be able to legally pay for anything using physical cash.

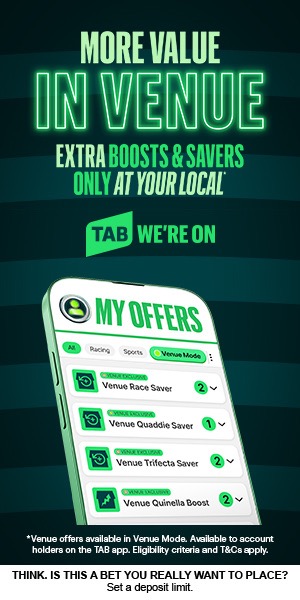

Further, paying for goods and services with cash helps assumes one’s right to privacy – of where, when, and what a consumer decides to purchase. For the hospitality industry, a customer may want to dabble on the pokies, TAB, or purchase food and beverages without being monitored by a business or lender. In this instance, having the ability to withdraw and pay with cash, allows the consumer a level of confidentiality in their own spending behaviours.

Additionally, physical cash helps big spenders set a budget that is ‘fixed’. A consumer heading to a club or pub can set their budget and stick to it by making a single cash withdrawal and holding onto their budgeted spend in physical notes and coins – in their pocket. While the cashless ‘tap and go’ option may be seamless, it presents a real danger of overspending for many consumers – especially in the hospitality scene.

A harm minimisation tool recommended for gamblers is to use physical cash. Leading researchers Dr Sally Gainsbury and Professor Alex Blaszczynski explain that cash is preferred by gamblers because of the breaks and limits it imposes: “The preference for the use of cash in gambling is often predicated on physical cash being a tangible way of limiting expenditure…”.

On the other hand, consumers may not realise that it actually costs businesses to accept some payment methods and card types. This is why it is common for merchants to charge a fee when the customer chooses to pay by a cashless means. From a consumer perspective, this extra fee may seem troublesome, especially during a time of inflation, however, the convenience of cashless payments comes at a cost for all.

Merchants may risk losing loyal customers – particularly those who belong to the older population if cash payments are removed from the industry. Cash is more than just a payment channel; it is secure, genuine, and difficult to counterfeit. Cash supports a merchant’s ability to grow and also leaves customers with their continued choice of all payment methods.

Roisin Selvarajoo

If you would like to see view previous articles, have a browse through the archive or use the search function

Loading…

In FY25, Victorian Keno players enjoyed almost 10 million wins worth more than $131.9 million.

For many club patrons across Victoria, FY25 was a year to remember – all thanks to a life-changing Keno win.

Victorian players had a standout year, tallying over 9.9 million Keno wins collectively worth than $131.9 million in prize money.

In FY25, Keno players across the eastern states of mainland Australia celebrated more than 76 million wins collectively worth more than $1.2 billion.

During this time, Keno crowned 20 millionaires and multi-millionaires who together took home more than $57.9 million. Two of these major jackpot winners were from Victoria.

Laverton woman thanks ‘manifestation magic’ for Keno win

A Laverton woman shared she was left thanking the universe after she scored a $60,000 Keno Classic 8 Spot prize at Club Laverton in the weeks leading up to last Christmas.

“It was a big surprise! Especially coming up to Christmas, it’s perfect!” she cheered.

“Do you want to hear something really funny? I just wrote in my diary the day before winning, ‘Thank you, universe, for my Keno 8 Spot win’. Then it really came true!

“I’m a firm believer in the law of attraction and manifestation, and I love affirmations!

“It was awesome seeing all eight numbers pop up on the screen.

“I’ve had a few wins in Keno over the years. It’s like the stars align for me when I play - it’s my thing!”

Club Laverton manager Gus Alimovski said the team happily shared in the excitement with their major Keno winner.

“What an incredible win for our patron! It’s always great hearing these winning stories, and now we have another one to share with our patrons,” he said.

“We’re thrilled for our customer, and we hope to see more Keno winners in our venue soon.”

All eyes on a winning FY26

Keno’s National Partner Manager Luke Harrison said he couldn’t wait to see which Victorian clubs welcomed the next big Keno winners.

“Last financial year, players at Victorian clubs celebrated some impressive victories,” he said.

“A key highlight has been the growing popularity of Keno’s Bonus and Replay features among club patrons. This trend reflects how venues are successfully connecting with their customers, sharing updates on jackpot increases, promotional offers, and game enhancements.

“When players opt into Keno Bonus, they unlock the chance to multiply their winnings by up to ten times, while the Replay option adds another layer of excitement.

“Many players are still unaware of these features, making it vital for staff to start conversations and educate them on the full range of Keno possibilities!”

Mr Harrison said the solid Keno performance at Victorian clubs last financial year laid a strong foundation for continued success in FY26.

“Clubs across Victoria are embracing fresh approaches to elevate the customer experience, and Keno’s rising popularity is playing a key role in that journey,” he said.

“There’s also a wide array of Keno resources available to clubs, from eye-catching point-of-sale materials to engaging promotions, all designed to keep the game front and centre.

“As the new financial year unfolds, Keno is looking forward to celebrating more big wins for Victorian club patrons, and more success stories for the clubs that host them.”

Contact your Business Development Manager to find out how Keno can best support your club in FY26.

Visit Keno Connect for more information on maximising Keno in your club - www.kenoconnect.com.au